can you pay california state taxes in installments

Importantly as soon as you know you cant pay back your taxes contact a tax professional. Box 2952 Sacramento CA 95812-2952.

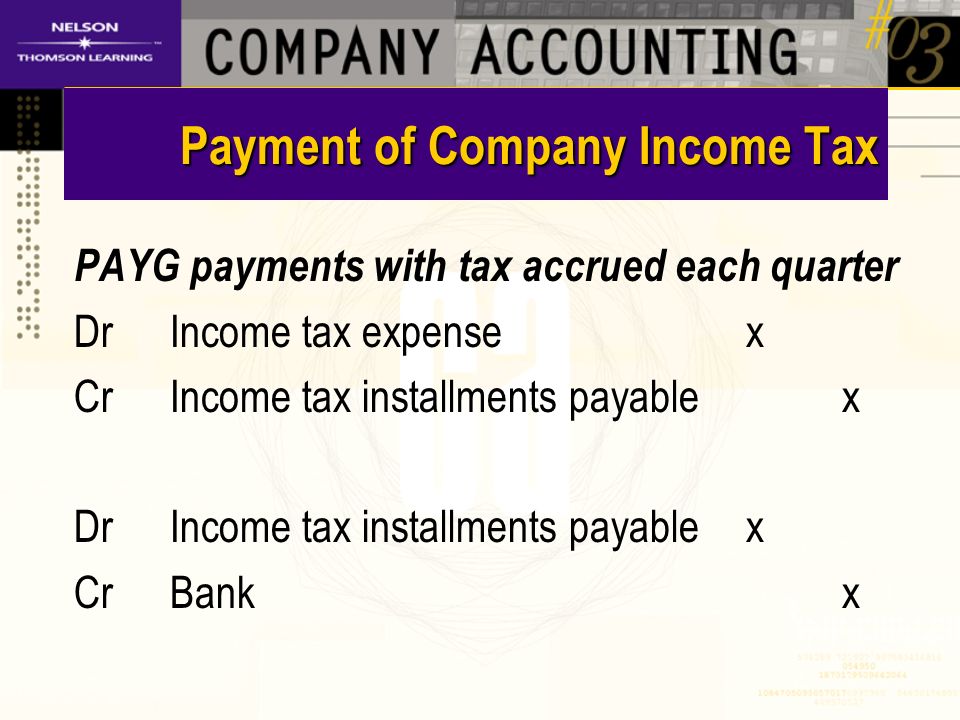

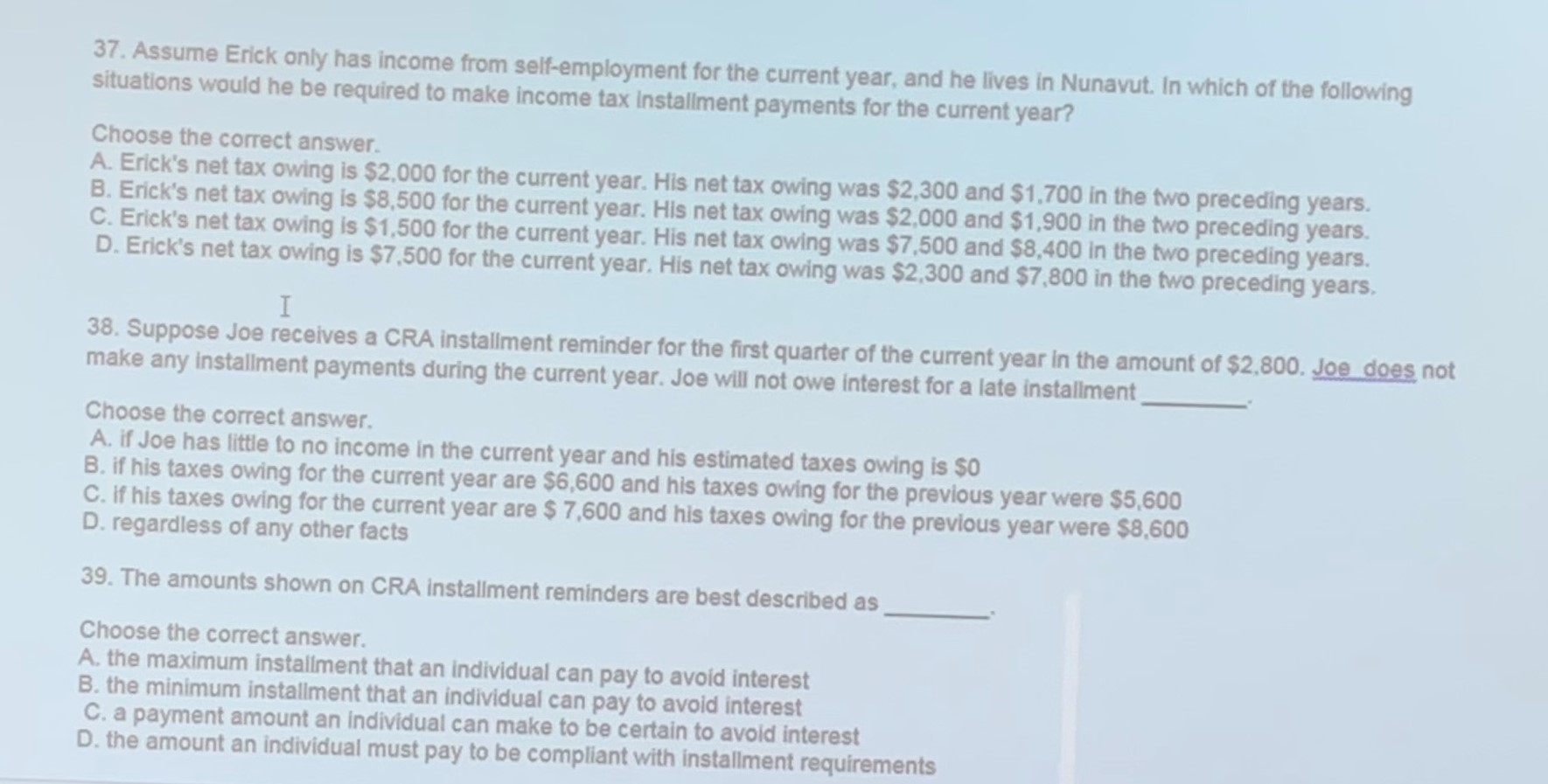

Chapter 12 Income Tax Ppt Download

If you are unable to pay your state taxes you can apply for an installment agreement.

. Important State gas price and other relief proposals. If you use the California Franchise Tax Boards FTB website you will enter your personal and payment information as requested no information will be pulled from any other location. However for a taxpayer to qualify for a remittance agreement all of the following must apply.

How Often Do You Pay Property Tax California. Installment Payment Guidelines What is an installment payment. If a Full Payment Agreement is not financially attainable you may be eligible for a Long-Term Payment Plan which entails an Installment Agreement.

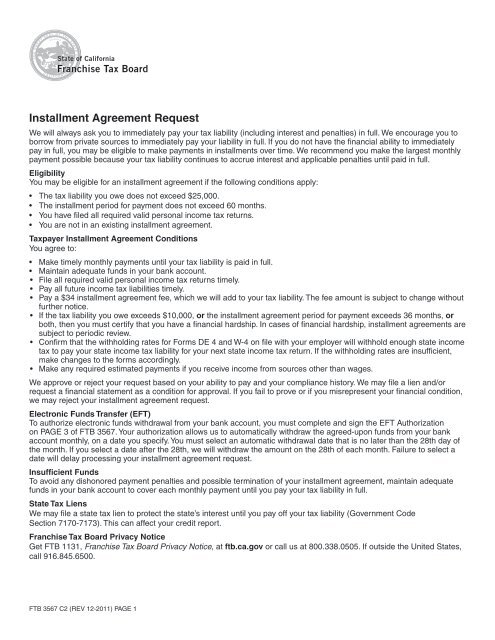

Like the IRS and many states the California Franchise Tax Board offers taxpayers the ability to pay taxes due over time. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. Active members can pay for their service credit purchase by electing the installment payment option.

Can I Pay My Taxes in Installments. I have installments set up for my federal taxes but I did not see an option for California state taxes. Check or money order Mail your payment or pay in person at a field office.

Ad Owe back tax 10K-200K. However its best to act sooner rather than later. Yes use httpswwwftbcagovonlinepayment_choicesshtml to pay your California income tax liability.

Your tax amount due is less than 25000. An extra 1-percent surcharge is also levied onto incomes of more. Get free competing quotes from leading IRS tax relief experts.

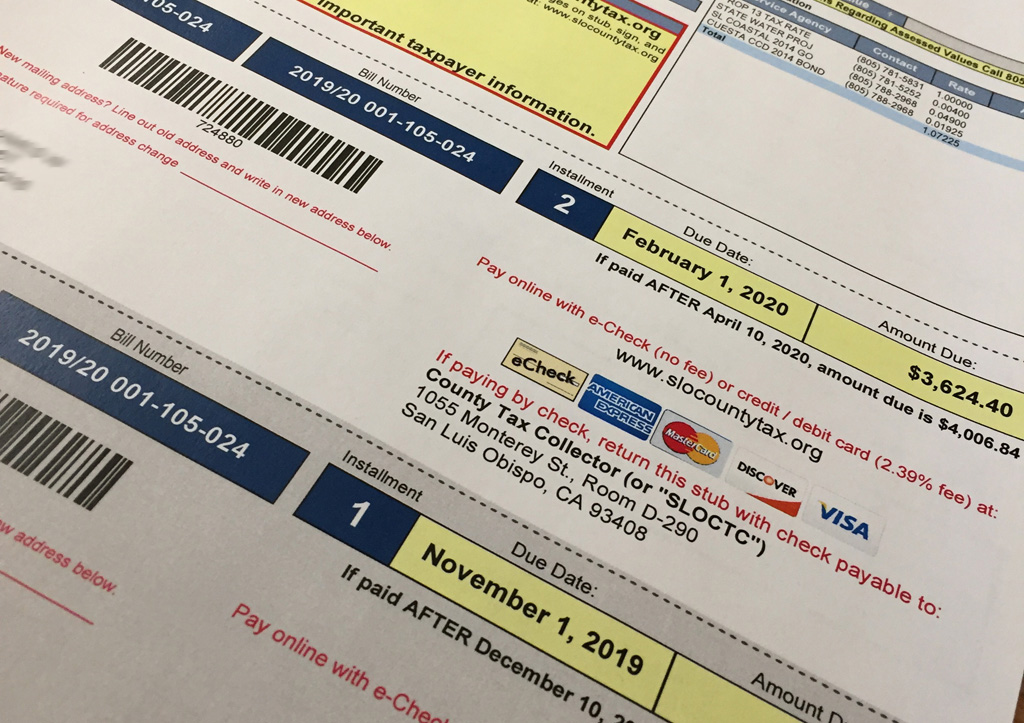

Both individual taxpayers and businesses can apply for installment plan agreements from the FTB. See if you Qualify for IRS Fresh Start Request Online. There is a two-payment schedule for property taxesProperty taxes for the fiscal year begin with the first bill mailed out on October 1st.

For example the State of California Franchise Tax Board accepts payment agreements for up to 60 months. However for a taxpayer to be eligible for a instalment payment agreement all of the following must apply. Ad Eliminiate tax debt issue.

For example if you buy unsecured property on january 1st your taxes will become due on august 31. If you are unable to pay your state taxes you can apply for an installment agreement. Installment payments are deducted from your paycheck each pay period and can be elected up to 180 monthly payroll periods or the equivalent based on your pay frequency.

These are levied not only in the income of residents but also in the income earned by non-residents who are working in the state. It may take up to 60 days to process your request. To avoid interest and penalties the last day to pay your tax liability in full is.

Fill out the attached Form 9465 Installment Agreement Request as soon as possible. Free Competing Quotes From Tax Relief Consultants. Like the IRS and many states the California Franchise Tax Board offers taxpayers the ability to pay taxes due over time.

If your request is accepted you will receive a notice with your monthly payment due date and amount. Bill or other balance due. An Installment Agreement allows you to pay your taxes over an extended period of time while avoiding collection actions from the IRS such as garnishments and levies.

The personal income tax rates in California range from 1 to a high of 123 percent. If approved it costs you 50 to set-up an installment agreement added to your balance. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other goodsWhile you may be seeing discussion in the mediasocial media on proposals related to gas prices and taxes we have no information to offer at this time because the ideas are only.

Can you pay california state taxes in installments. An application fee of 34 will be added to your tax balance when you request an installment agreement. Questions answered every 9 seconds.

100 of the preceeding years tax. The highest rate is levied at income levels of at least 526444. For example the State of California Franchise Tax Board accepts payment agreements for up to 60 months.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. The application takes 90 days to process and costs 34 for individuals and 50 for businesses. If youre applying for an installment plan for personal taxes you must meet certain eligibility criteria.

Californias Property Taxes You are required to pay your California property taxes either bi-annually or each year in a couple of installments. It may take up to 60 days to process your request. Dont Let the IRS Intimidate You.

The filing deadline is not too far away and unless you want to miss the deadline you should make up for lost time with your return and pay as much as you need up until the deadline. The average effective after exemptions property tax rate in california is 079 compared with a national average of 119. By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO.

Solvent can also help. Typically you will have up to 12 months to pay off your balance. Usually you can have from three to five years to pay off your taxes with a state installment agreement.

Understanding Your Property Tax Bill Town Of Lincoln

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Lease And Buy Agreement Real Estate Forms Real Estate Real Estate Contract

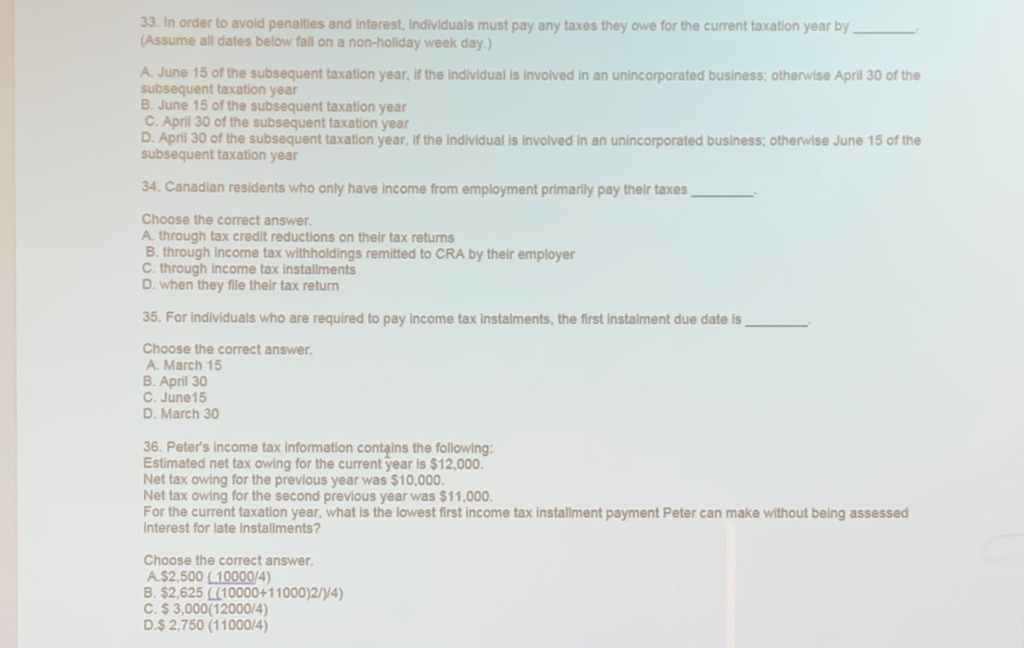

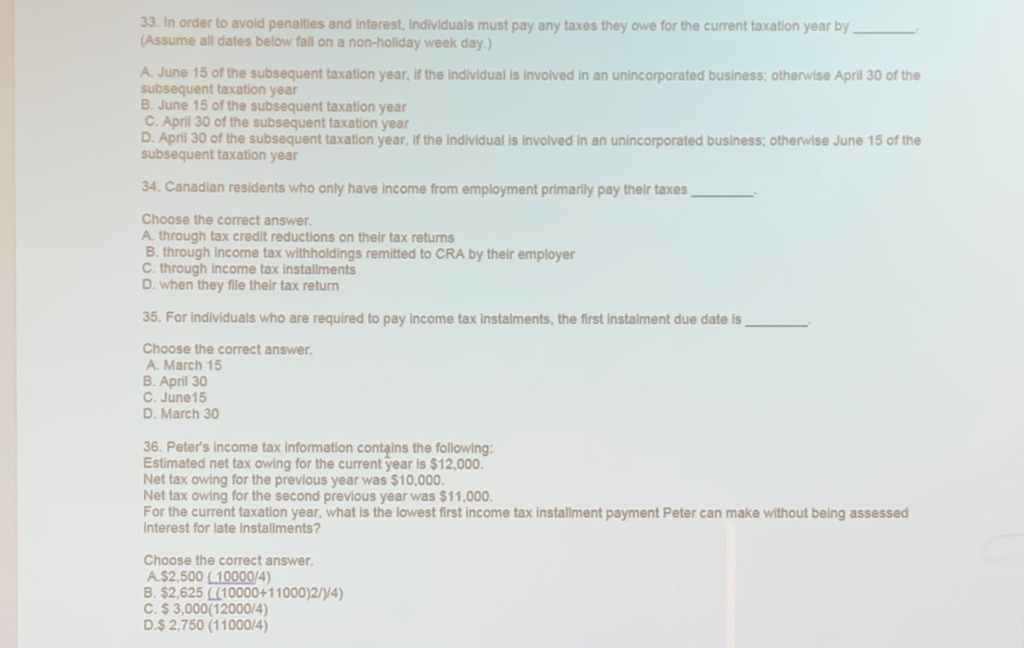

33 In Order To Avoid Penalties And Interest Chegg Com

37 Assume Erick Only Has Income From Self Employment Chegg Com

Can I Pay Taxes In Installments

Pin On Letter Of Agreement Sample

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

6 Things You Should Know Before Filing Your Taxes Nailpro

Installment Agreement Request California Franchise Tax Board

Irs Letter 4458c Second Installment Agreement Skip H R Block

Stimulus Checks Child Tax Credit Payments To Start July 15 How Much Will You Get Syracuse Com

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

San Jose 1886 Old Map Reprint Advertising On Edges Etsy Old Map Old Maps California City